Homeowners Insurance in and around Boise

Homeowners of Boise, State Farm has you covered

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

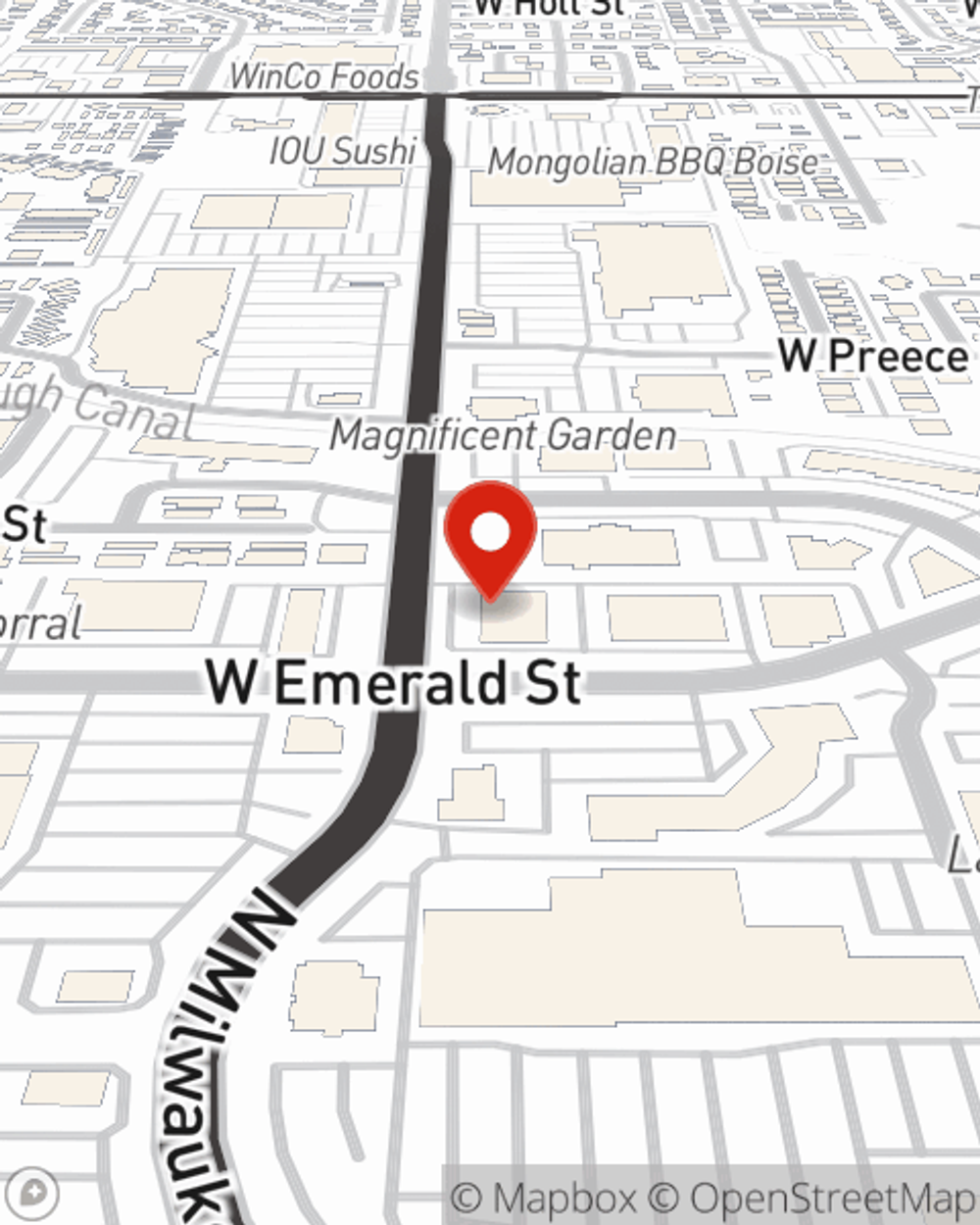

- Boise

- Ada County

- Canyon County

- Star

- Meridian

- Eagle

- Owyhee County

- Melba

- Middleton

- Caldwell

- Garden City

Welcome Home, With State Farm Insurance

Home is where laughter never ends friends always belong, and you enjoy coverage from State Farm. It just makes sense.

Homeowners of Boise, State Farm has you covered

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Why Homeowners In Boise Choose State Farm

State Farm's homeowners insurance protects your home and your collectibles. Agent Ian Johnson is here to help create a policy with your specific needs in mind.

Your home is the place where your loved ones gather, but unfortunately, the unpredictable circumstance can happen. That's why you need State Farm's homeowners insurance. Plus, if you need some more air space, our bundle and save option could be right for you. Ian Johnson can help you get the information you need!

Have More Questions About Homeowners Insurance?

Call Ian at (208) 375-1931 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

How to use public Wi-Fi safely

How to use public Wi-Fi safely

When using a public Wi-Fi access there can be risks involved. We’ve provided some steps to help protect your information.

Ian Johnson

State Farm® Insurance AgentSimple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

How to use public Wi-Fi safely

How to use public Wi-Fi safely

When using a public Wi-Fi access there can be risks involved. We’ve provided some steps to help protect your information.